Bitcoin wallets let you become your own bank. It’s the reason they are a revolution in finance.

However, not all Bitcoin wallets deliver on this promise. In fact, some wallets purposefully take it away. Nonetheless, getting into Bitcoin will always bring you to make a choice of a wallet.

The two things that you have to be aware of in order to make an informed decision on a Bitcoin wallet are:

- Bitcoin wallets don’t store bitcoin in them, they are stored on the blockchain

- Bitcoin is not private by default, using it leaves publicly available tracks

Having this in mind is what will give you a picture of what you might have traded away in your choice of wallet. Rather than jumping blindly into a choice, the qualities highlighted in this article help you:

- Find a Bitcoin wallet that suits you

- Keep your Bitcoin safe

- Avoid possible mishaps while using Bitcoin since transactions are irreversible once confirmed

- Use Bitcoin privately

1. You Want Your Bitcoin to be Safe.

When it comes to your hard-earned Bitcoin, the worst that can happen is that you lose it all.

Often this is the price you pay for not understanding how Bitcoin wallets work.

Bitcoin wallets don’t keep any bitcoin in them. Instead, they store the relevant credentials called private keys that allow you to control any bitcoin sent to you. Losing these keys means losing your bitcoin.

The safety of your bitcoin depends on who stores your private keys and how they do it.

Who has Control of Your Private Keys?

You can either keep your private keys or trust someone else to keep them for you.

This creates the two major classes of wallets in terms of control:

- Custodial Wallets – someone else has your private keys and they control access to your funds.

- Non-Custodial Wallets – your private keys are in your possession and only you can control your funds.

This is similar to a bank vault for your assets. You either let the bank store your assets for you or you have a personal vault at home.

Custodial Wallets

You don’t own the vault at the bank, the bank does but they offer a service that will allow you to access your assets. You have trusted them enough to know about your assets and store them for you.

Similarly, in custodial wallets, third parties are entrusted to permit you to transact and to keep your Bitcoin safe. A common example of custodial bitcoin wallets is centralized bitcoin exchanges.

Non-Custodial Wallets

The vault at your home is yours and yours alone. You’re responsible for its safety and only you control who can or cannot access your vault. Likewise, non-custodial wallets give you full responsibility for the security of all of your Bitcoin.

Keeping Your Non-Custodial Wallet’s Seed Phrase Safe

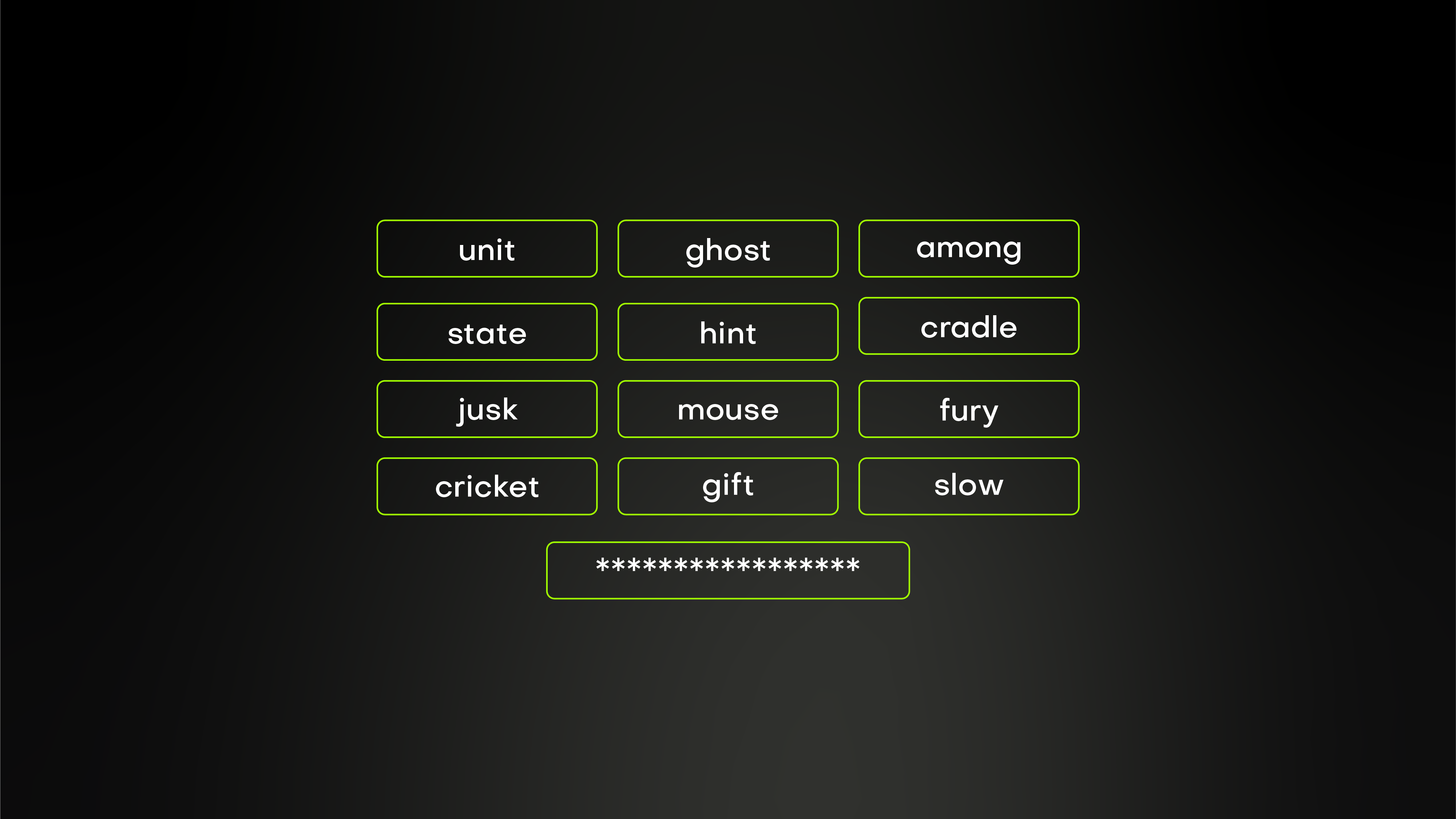

Going the non-custodial route means that you’ll have the wallet’s seed phrase to keep safe.

This mnemonic phrase is what you use to initiate or recover your wallet. It is also the source of your private keys and the public keys you use to receive bitcoin in your wallet.

Understandingly, this seed phrase should be for your eyes only. If any other person has it, they can use it to recreate your wallet and steal your funds.

What is also worth noting about seed phrases is that bitcoin wallets go about them differently.

Depending on your wallet, the length of the word phrase will vary from 12 to 24 words. While more words mean stronger security from a potential brute force, a 12-word seed also does the job.

Which Way to Go, Custodial or Non-Custodial?

Custody is a big deal with bitcoin because Bitcoin’s core intent is to remove any third parties or intermediaries from how people transact. Despite that, the type of custody you choose only matters to the extent that it can keep your bitcoin safe.

With Custodial Wallets, you can lose your bitcoin if the central exchange gets hacked, goes bankrupt or your funds get frozen.

Funds in your non-custodial wallet will always be safe as long as you can keep a secret. However, your funds will be gone if you lose your private keys either by accident or through theft.

How Does Your Bitcoin Wallet Store Your Private Keys?

Your bitcoin wallet can either be Hot or Cold. This depends on whether the private keys are stored on a device connected to the Internet or not.

Bitcoin wallets that run on the web, on desktops and on phones are considered hot. The term hot refers to their extent of connectedness to the Internet to allow for transactions.

Cold wallets use hardware that has no ability to connect to the internet and are considered the safer option between the two. Examples of such cold wallets are Trezor, Coldcard and Ledger.

The choice between cold and hot wallets is motivated by the length of time and the amount of bitcoin one wishes to store. The common practice involves keeping huge amounts of Bitcoin in cold wallets and intermittently transferring small amounts to hot wallets for transactions.

Watch out for Fake Wallets

Fake Bitcoin wallets and exchanges exist primarily to swindle you of your Bitcoin.

Be vigilant of fake websites. Cybercriminals try to exploit new users by imitating legitimate websites using a different domain extension, and can even pay to promote these scams to the top of search engine results. In the case of application installations, make an effort to verify the authenticity of your downloads using PGP keys.

2. Your Financial Privacy Doesn’t Have to be Sacrificed

Bitcoin wallets are not private by default. When you don’t prepare for this, anyone can access your private financial data.

Your wallet leaks your transactional information when:

- Your wallet needs KYC(Know your Customer) details for you to transact

- Your wallet reuses addresses in transactions

- Your wallet does not incorporate any privacy-enhancing techniques like Tor

- Your wallet accesses the blockchain’s data through a third party instead of directly

So what can wallets do for your privacy?

Bitcoin Wallets can Work With Zero Knowledge(zk)

Bitcoin is a permissionless technology. All wallets can work and let you transact without revealing any personal information to the wallet service. This includes how your wallet accesses the public ledger.

When your wallet needs your personal information in order to use it, you ultimately surrender your privacy. This might be what seems like common practice with exchanges but the personal information collected is meant to be used against you, not used for your protection.

Wallets Should Always Generate A Fresh Address for New Transactions

A wallet that does not allow you to generate new addresses for transactions you receive will hurt your privacy. Since all addresses can be publicly viewed, receiving bitcoin using the same address multiple times will remove any doubts that two transactions were made to the same entity.

Address reuse hurts your privacy as the sender also, so before you spend your Bitcoins, check the address you are paying merchants or exchanges and request a new one if you see it has already received coins before.

There are also other risks associated with address reuse in Bitcoin.

Privacy Tools can be Built Right Into Your Wallet

Since Bitcoin implements a public ledger to keep transactions, privacy consideration cannot come as a second thought when picking a wallet.

For users who are conscious about their privacy, multi-participant transactions like coinjoins and the Lightning Network provide a crowd to hide in. That said, having a wallet with built-in privacy tools will make safeguarding your privacy effortless.

3. Your Bitcoin Wallet Should be Nice to You

A wallet’s user-friendliness is what inevitably makes your Bitcoin experience smooth. It will also be what stops you from making unintended mistakes.

But how exactly can a wallet be nice to you?

Your Wallet Helps You Track Your Transactions

The pseudonymous nature of Bitcoin transactions can quickly throw you into an organizational chaos.

The easiest way a wallet can help you follow the privacy properties of your addresses is by offering you a way to label your deposits and expenses.

Your Wallet Stops You from Sending to Faulty Bitcoin Addresses

If you send your coins to the wrong address, you might never get them back. This means you’ll always have to exercise care when sending bitcoin and your wallet can help you with this. How exactly?

A wallet can detect invalid addresses and help you double-check addresses before confirming transactions.

Your Wallet Saves You from Erroneous Transaction Fees

If you were to pay for a $15 meal with two $20 bills, you would confuse the cashier since you could complete the payment with a single $20 bill.

Bitcoin wallets should avoid this confusion as well. Since transactions with extra input addresses waste an unnecessary amount in mining fees. A wallet should be smart enough to only spend just enough coins to make your payment, without overusing your wallet’s balance.

A Friendly Wallet Offers You A Back-Up Option

Seed phrase backups are a critical feature that will allow you to quickly recover your wallet in case of accidents.

A Simple User-Friendly Interface is the Way to Go

Is the wallet’s design straightforward to use? Only when it makes it easy for you to find your way around it regardless of your level of tech expertise can it be considered easy to use.

There Is Always Room for A Better Experience

Having a wallet that is upgradable means that any experience you currently have can be made better. Moreover, new updates are what inevitably resolve new bugs, improve usability, and fix vulnerabilities.

You’ll Need Technical Support When Things Go Sideways

Whether in the form of documentation, video tutorials, or live customer support, good technical support goes a long way. When it comes to your valuable bitcoins, having a helping hand when you get stuck is a nice thing to have.

Can There Be A Perfect Bitcoin Wallet?

Fatefully for Bitcoin, no single wallet can rule them all. In fact, the nature of Bitcoin is that anyone can make their own wallet if they so wish.

Regardless of this, the best bitcoin wallet will always remain the one that keeps your bitcoin safe, shields your privacy and is friendly to you.